WITH THE BUSINESS CONSULTANCY SERVICES DUBAI TO PROVIDE A RIGHT PLATFORM FOR FLOURISHING BUSINESS

Dubai comes in the top list as one of the most fabulous destinations places for a business formation. Most people dream to set up a business in the dream city so, without any doubt, Dubai’s market is friendly and friendly. It has the top facilities and features which no other nation in the world offers.

But establishing a business in a new country is quite a hard and difficult task. This can be made simple with the help of business consultancy services Dubai. They will offer and help you with the optimal solutions and will assist in making your dream come true.

List of business consultancy services Dubai Company Formation

The Business consultants will assist and guide you in setting-up of the company without any fight and complicatedness. They will look after all the legal paperwork and procedures. Company development entails many licenses and approvals. No need to worry about anything as the entire matter will be done by the Liquidation Services In Dubai. They will also help in providing you the top solution for your company’s funding and will manage the bank accounts, license and other transactional paperwork that would be essential to setup a business in Dubai.

The business adviser will provide you a clear picture of how the tax system and the policies work and the ways to be handled. They will assist you to develop in the market and will provide the most excellent solution against your contestant.

If you are planning business in a new country, you will not have enough knowledge about the market styles and its associated information hence choose best Business Consultancy Services Dubai. But with the help of a business consultant, you will add knowledge about the business market, existing infrastructure information. The strategies to come first and to stick out in the market, technology, and web traffic analysis and lots more.

UAE FREEZONE COMPANY FORMATION MAKES YOUR BUSINESS PROFITABLE

Best Auditing Services In Dubai prove that a company’s fiscal records and accounting processes fulfil with the law. They carry out reviews of financial statements and records to verify in public held companies come across their authorized requirements under U.S. laws. Companies that are not openly traded hire Auditors In Dubai to make sure that internal accounting procedures and financial processes work smoothly, and that consistent accounting practices are retained properly.

Accounting Standards

Moreover checking financial records for precision, an auditor assessment a company’s accounting technique and method to validate that the company follows steps to stop scam. The auditor attests a company’s in-house rules for signing checks, making payments to retailers and handling deposits. The company should also meet the requirements about people who have access to funds. An audit by a qualified independent auditor allows a company and its creditors understand where it stands with respect to following standard accounting values and guidelines.

Internal Controls

Auditors In Dubai prove that internal controls and methods are in place for organizations they audit. They recognize significant areas that might require improvement, and they check the routine of new technology and accounting systems. Auditors also assess the quality of record-keeping processes and can search out deceptive events unseen in documents. Auditors analyze a company’s financial information to make sure that taxes are paid correctly and processes are maintained to defend the security of a company’s financial statistics.

Importance of Auditors In Dubai

Auditing gives guarantee to investors and creditors that company funds are managed correctly. Auditors defend the public from investing in companies that use crooked business practices or that effort to cheat investors with fake financial statements. By assessing financial statements and digging into accounting records, auditors can establish whether the financial statements and records accurately show the company’s true financial profile.

The points as given above make it very clear that there are plentiful benefits which a company can benefit by carrying out a financial audit of the company.

.

MAKE ACCOUNTING PROCESS EASIER AND FASTER WITH THE AUDITORS IN DUBAI

TYPES OF LIQUIDATION SERVICES IN DUBAI

The Liquidation Services In Dubai includes the change of an enterprise’s resources into cash, remunerated to various tops which used to add to the maintenance of the company. For example, a company might be liquidated to recompense the debts to the creditors; the lending companies or a bank from which the company required loans once.

It is the previous option which lenders choose by UAE freezone company liquidation, as a company which is in best possible financial health is not subjected to the liquidation process. However, if a company isn’t offering any appropriate growth and the debtors cannot able to pay the debt, and then creditors opt to take action against the organization on behalf of their money.

Liquidation Services In Dubai – In the procedure, the possessions of the company; land, machinery, raw material, products, and other sell-able items are auctioned or retailed straight to a potential buyer. The cash, which is received from the selling of the entire things, is then allocated amongst the lenders.

Benefits

- It occurs to the company, not the people within the company.

- Management of the liquidation is approved on top of the selected liquidator; alleviating some of the anxiety that a director can acquire thus of the procedure.

- Once the company is liquidated, creditors can no longer follow directors for expense.

- As quickly as the company closes, all legal battle against the company is prevented.

Types of Liquidation

Company liquidation is two types:

1. Voluntary Liquidation

In a category voluntary liquidation, the investors of a company will choose to ploy the company as they have no money to back creditors. In this kind of liquidation, main concern is given to the creditors

2. Compulsory Liquidation

Compulsory liquidation is a kind of company liquidation which is present by court order. Here, the resources of the firm are dispersed to the creditors and contributors based on the precedence of claims.

KEEP YOUR BUSINESS RUNNING PROPERLY WITH THE BUSINESS VALUATION SERVICES IN UAE

Business Valuation Services In UAE – There are several reasons why you want an existing assessment of your business and lots of business owners take for granted that it is only required when selling but in fact, this is not the case.

However, selling your business is a main premeditated move and understanding the packed value of your business as it presently stands, plus future prospective is compulsory to make sure that you obtain the best possible price.

Better Knowledge of Company Assets

It is most vital to get a correct business assessment appraisal. Approximations are not good enough as it is an overview.

Particular numbers require to be profited from valuation procedures so that business owners can get hold of appropriate insurance coverage, understand how much to invest into the company, and how much to put up for sale your company for so that you still make a revenue.

Also Read :- Vat Registration In UAE

Understanding of Company Resale Value

If you are considering selling your company, understanding its exact value is required. This procedure must be commenced rather than the business goes up for sale on the open market because you will get an opportunity to take enough time to augment the company’s value to attain a higher selling price. As a business owner, you must know what your company’s assessment is.

You must be aware of what your company’s resale value in fact is to negotiate a higher selling price.

Acquire a True Company Value

You will have an overview of what your business is important that is based upon straightforward data such as stock market value, total benefit value and company bank account balances. Business Consultancy Services Dubai However, there is enough to business assessments than those effortless factors. Work with a trustworthy valuations company to make sure that the accurate numbers are given.

It also assists to illustrate company income and valuation increase over the course of the before five years.Business Valuation Services In UAE

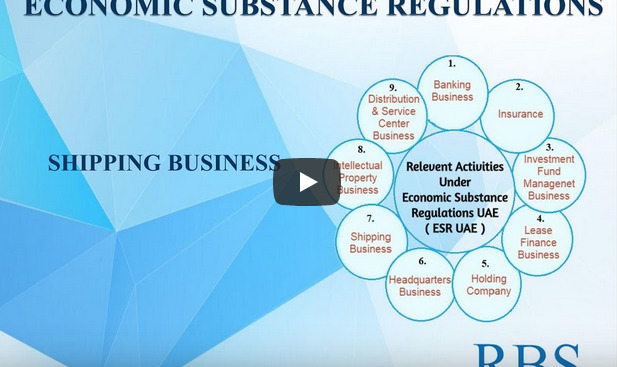

SHIPPING BUSINESS UNDER ESR IN THE UAE SIMPLIFIED BY RBS GROUP

hipping business under Economic Substance Regulation in the UAE Simplified by RBS Group

Link for- Distribution and Service Centre Business:-https://youtu.be/IpGqqduyg2g

Link for- Holding Company Business:-https://youtu.be/C0xKRidim8o

ESR IN UAE – RELEVANT ACTIVITY- DISTRIBUTION AND SERVICE CENTER BUSINESS.

Link for- Shipping Business:- https://youtu.be/8EITmYZcQAw

Link for- Holding Company Business:- https://youtu.be/C0xKRidim8o

Economic Substance Regulation – Holding Company Business

Link for- Shipping Business:- https://youtu.be/8EITmYZcQAw

Link for- Distribution and Service Centre Business:- https://youtu.be/IpGqqduyg2g

##This channel is created by RBS for providing information for educational purpose only

WITH THE VAT REGISTRATION IN UAE FILL PROPER VAT FORM